Trinidad and Tobago’s financial system entered a kind of purgatory in 2017, when a global watchdog group that sets standards for combating money laundering, terrorist financing and other related financial threats—the Financial Action Task Force (FATF)—placed the country on its “gray list” for noncompliance.

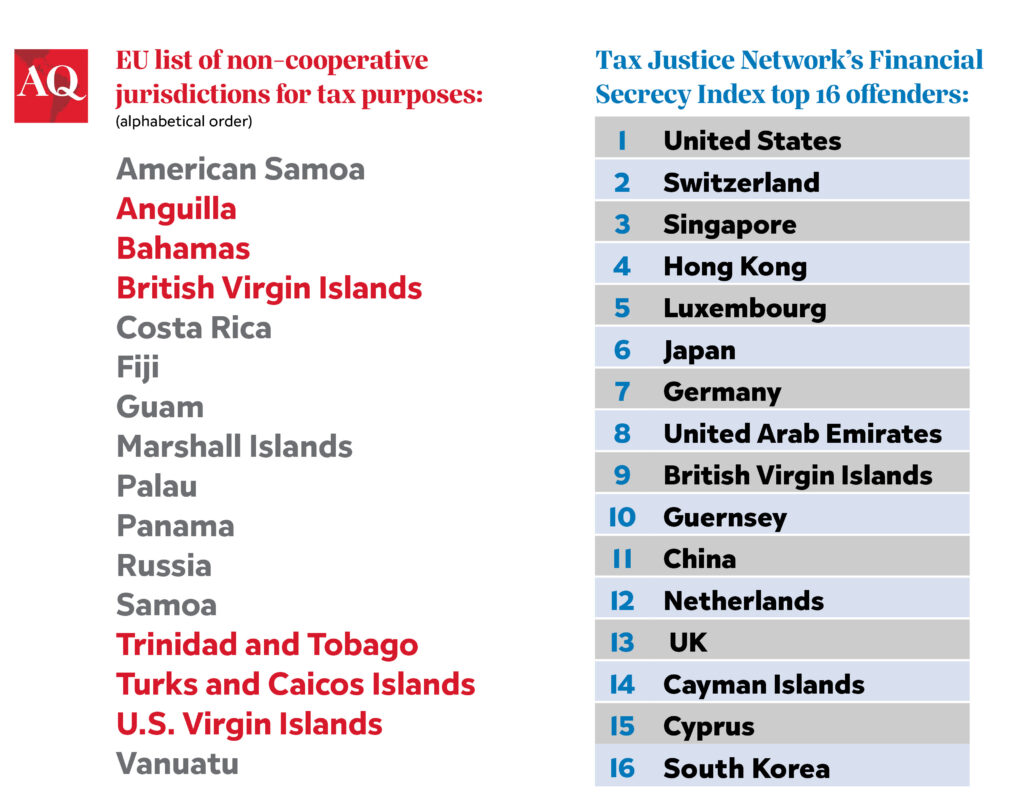

It was removed from that list in 2020 after years of work to reform its financial laws and strengthen enforcement, but the country remains on the European Union’s own list of “non-cooperative jurisdictions for tax purposes”—also called its tax haven list—with no clear path to removal.

Such lists are meant to combat the undeniably urgent problem of money laundering, which the UN estimates may account for as much as 2.7% of global GDP. But some analysts and advocates are questioning whether Caribbean countries are unfairly singled out, creating a possible double standard that causes them to suffer disproportionate harm to their economies and reputations.

To be sure, the Caribbean is rightly known for its tax havens and as a center for money laundering. But financial wrongdoing also occurs in the U.S. and Europe, where much of the money comes from in the first place; even U.S. Treasury Secretary Janet Yellen said recently that “the best place to hide and launder ill-gotten gains is actually the United States.”

And given the limited resources available to Caribbean economies, it is not fair to hold them to the same standards as larger nations, said Channing Mavrellis, illicit trade director at the Global Financial Integrity think tank based in Washington. “The huge challenge in Caribbean countries is just capacity … It’s wrong that we expect so much from them [given] what they’re working with.”

Last September, Barbados’ Prime Minister Mia Mottley, an increasingly prominent spokesperson on regional issues, testified before the U.S. Congress on the harms done in the Caribbean by international financial regulations. She highlighted blows to financial inclusion, saying it can take “weeks or months” for locals and foreign investors to open bank accounts. To combat this problem, Barbados launched a national digital ID card last year. “But that costs us millions of dollars,” Mottley said, and is just one example of how Barbados “has had to divert money away from social spending and critical infrastructure spending in order to ensure that we do not have our banks cut off from the rest of the world.”

She added that Barbados now monitors all transactions over $5,000 while the U.S. floor is $10,000, telling U.S. legislators, “The bottom line is that … like women, we are doing twice as much as you to be considered half as good.”

On the ground, the consequences are piling up. “I can’t tell you how many examples I am aware of where transactions between us in the Caribbean and people in EU territories are blocked,” Marla Dukharan, an economist from Trinidad and Tobago, told AQ. “We’re subject to all kinds of unjustifiably enhanced due diligence, penalties for the reputation, like visa restrictions and loss of investor confidence,” she said, “and, ultimately, socio-economic costs heaped upon already struggling economies.”

Overlapping and opaque standards are part of the problem. The FATF has made its criteria clearer over the past few years, but the EU’s transparency criteria remain especially non-transparent, said Andrew Dalip, a lawyer from Trinidad and Tobago who specializes in anti-money laundering (AML) policy in the Caribbean and is supporting the government of Belize with its FATF evaluation process. This lack of clarity is significant because the EU list can make the nations on it “pariahs in the international financial system,” Dalip said.

“The entire edifice of international financial regulation is fundamentally racist, not in intention, but in effect,” said Alex Cobham, the director of the Tax Justice Network (TJN), a transparency advocacy group based in the UK. He argues that financiers from the U.S. and Europe established Caribbean tax havens in the first place, and now their countries are imposing harsh penalties on the Caribbean while leaving their own tax havens, from Luxembourg to Wyoming, unscrutinized—even though the U.S. and European countries enable more laundering and tax abuse than anyone else, according to TJN’s Financial Secrecy Index.

For example, the EU’s tax haven list includes just two jurisdictions—the Bahamas and the British Virgin Islands—of the 20 that TJN identified as the world’s worst corporate tax havens—among them France, Belgium and the Netherlands. In February, Oxfam called the EU list a “joke,” declaring that “not only did it delist countries with zero corporate tax rates, like Bermuda and Cayman Islands, but ignores EU tax havens, like Luxemburg, despite it being one of the most harmful tax havens in the world.”

Trinidad and Tobago’s years-long struggle to get off international lists has been draining, even though it has the largest economy among Caribbean Community and Common Market (CARICOM) nations. Smaller countries are even more vulnerable. Belize, a nation of around 400,000 people, was especially hard-hit when U.S. authorities tightened bank regulations and enforcement in the wake of the 2008 financial crisis. In 2015 and 2016 alone, Belize lost 83% of its correspondent banking relationships, as international banks “de-risked,” leaving the country due to higher due-diligence costs and fears of penalties for operating in a country with poor controls. The IMF reported that this de-risking made Belize’s banking transactions slower and more expensive, lowered the value of wire transfers, hurt importers and exporters and caused a sharp drop in deposits in domestic banks. The country is still recovering, and is now progressing through an FATF evaluation, which can take years to complete.

On the ground in places like Barbados, which remains on the FATF gray list even though it was removed from the EU’s list in February, “Small businesses and most normal people are just worried about how the red tape has grown exponentially,” said Peter Wickham, director of Caribbean Political Research Services.

Mottley, the Barbados leader, pointed out that investigations in the wake of Russia’s invasion of Ukraine showed that “Russians didn’t choose the Caribbean to hide their money … They chose London and New York and Switzerland.” Yet, look at the countries on the lists, she said, “and you will see that they are almost all former colonies and people of color.” For Dukharan, the economist from Trinidad and Tobago, “What’s missing is fairness.”