The specter of resource insecurity is back. Intensified resource stress, driven in part by the booming demand from emerging economies and a decade of tight commodity markets, is reshaping the global economy. Whether the resources are actually diminishing is a matter of debate, but one thing is clear: the resources sector is increasingly characterized by supply disruptions, volatile prices and rising political tensions over access. In many places, myopic government policies have exacerbated the challenges.

This story is not new. When fears over resource scarcity have arisen in the past, crisis has been averted by an influx of investment and breakthroughs in technology. Some analysts argue that we are witnessing the same phenomenon today—that the maturation of oil and gas technologies will increase global energy supply, while the global economic downturn will dampen demand. Resource-related tensions, they say, are likely to ease in the years ahead.

But we must face the hard facts. The fundamental conditions that gave rise to the tight markets over the past 10 years still exist. The world remains only one or two bad food harvests away from another global crisis. Meanwhile, lower prices for fossil fuels and other commodities may simply trigger another resource binge, especially in the large and growing developing countries.

These variables present an unambiguous reality: the world’s natural resources are now governed by a new political economy. New global trends are emerging in the production, trade and consumption of both raw materials and intermediate products. Meanwhile, governments and other stakeholders are working to secure their access to those resources. In doing so, they are creating new fault lines on top of existing weaknesses and environmental uncertainties.

In a new report by Chatham House, Resources Futures, I and my colleagues Felix Preston, Jaakko Kooroshy, Rob Bailey, and Glada Lahn argue that resource politics, not environmental preservation or sound economics, are set to dominate the global agenda in the years ahead. Indeed, resource politics are already playing out, whether through trade disputes, climate negotiations, market manipulation strategies, aggressive industrial policies, or the scramble to control frontier areas.

Who’s Buying and Who’s Selling

Emerging economies lie at the heart of this new, evolving political economy of resources—with China and India’s growth as consumers and producers affecting multiple resource markets. Global trade in natural resources has grown nearly 50 percent from a decade ago, thanks in large part to the ever-increasing appetite for oil, iron and steel, coal, oilseeds, and cereals in emerging economies. In the past 10 years, worldwide consumption of coal, palm oil and iron ore has grown at rates between 5 and 10 percent per year, while consumption of oil, copper, wheat, and rice has been increasing by 2 percent annually.

Global demand for major resources such as fossil fuels, food, minerals, fertilizers, and timber will continue to grow until at least 2030. While much of the consumption will come from the traditional powers and a bloc of advanced emerging economies, including Brazil, Russia, India, Indonesia, China, and South Africa, a new wave of developing countries such as Iran, Thailand, Turkey, and Vietnam will also become critical resource clients in the coming decade.

Meanwhile, resource production remains concentrated in a handful of countries. For 19 resources ranging from crops, timber, fish, meat, metals, and fossil fuels to fertilizers, the three largest producers of each commodity account for on average 56 percent of global production. Eight players dominate the production landscape: China, the United States, Australia, the European Union, Brazil, Russia, India, and Indonesia.

Other nations that have the capacity to produce significant quantities of one or two resources include Argentina (soybeans), Saudi Arabia (oil), Iran (oil and gas), Canada (gas, zinc and nickel), and Chile (copper). For resources with smaller production volumes, such as palm oil or many specialty metals, concentration among producer countries is even higher.

But even as the old producers dominate, a number of new players have emerged on the scene, thanks in many cases to large-scale foreign investment. Peru has become an important producer of copper and zinc, while Angola is demonstrating its potential as a major supplier of oil and gas. Mongolia (copper and coal) and Mozambique (coal and gas) may soon follow suit. Paraguay has recently become the world’s fourth-largest exporter of soybeans.

The story is not all rosy. The fast-expanding resource sectors in these countries are becoming flashpoints for domestic social and political tension. And not everyone is getting in on the game at the same speed. The nations of sub-Saharan Africa are conspicuously underrepresented on the list of major resource-producing countries. Despite the hype over the “new scramble for Africa,” many of the agricultural or extractive investments that have been proposed on the continent remain notional or have yet to become operational.

Price Volatility Is the New Normal

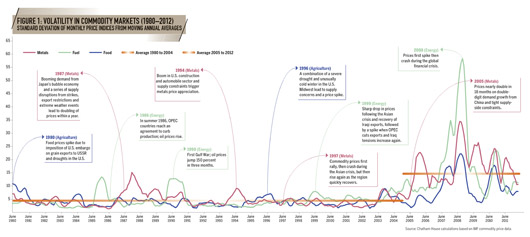

After a period of relatively low instability in the 1990s, annual price volatility across the commodities markets is now higher than it has been at any time in the past century, with the exception of the 1970s for energy prices. While brief periods of volatility are not uncommon, the sustained high levels of volatility since the early 2000s mark a new trend.

The concrete causes of the high twenty-first-century price volatility are the subject of much debate. Some experts argue that the recent trend has been caused by a combination of tight supply and demand shock from emerging economies. Others lay the blame on wary, intensified speculation on financial markets. Still others attribute it to an uptick in government interventions such as export restrictions.

Each of the above has an element of truth. Dynamics of resource production and consumption are interwoven through markets, commerce and the global environment. Any constraint on the future production of any particular resource depends not only on its price and availability, but on the accessibility and cost of the other natural resources used to produce it.

Local disruptions, whether from extreme weather or labor unrest, can rapidly cause resource prices to spike in international markets. These price increases in turn create macroeconomic pressures for governments, especially in consumer nations. According to the International Monetary Fund, in 2011 high prices of basic resources led to a doubling of inflation rates in low-income countries, where these staples constitute half of consumer spending. Poor populations, which spend most of their income on basic resources such as staple foods and fuel, are often particularly hard hit by strong price fluctuations.

And price fluctuations have serious implications on long-term global economic security. Price volatility increases risk margins, which can deter long-term investment in production, potentially leading to a more limited commodity supply in future years. More immediately, price volatility can cause trade and investment disputes, or trigger diplomatic tensions—and possibly even militarized responses—among trading nations.

Figure 1: Volatility in Commodity Markets (1980-2012)

Click directly on the image to access a larger version of the figure.

Uncertain Markets, New Politics

In response to high and volatile prices, a number of political and economic realignments are under way. Keen to guarantee their access to resources in a time of scarcity, Middle Eastern importers of food and Asian importers of raw materials are building economic and trade relationships with the major producing regions. Producer countries have responded with policy measures of their own. Brazil and Argentina have, for example, restricted foreign land ownership, while Canada and Australia have occasionally denied foreign access to mining assets. Several U.S. legislators have called for limiting shale gas export licenses to keep cheap gas at home.

Production is already concentrated among a few major exporters. If high prices persist, the Organization of Petroleum Exporting Countries (OPEC) may soon be joined by new international cartels in other resource markets. The Russian government, for instance, proposed a Black Sea wheat export cartel comprising Russia, Ukraine and Kazakhstan at the World Grain Congress in 2009. Thailand and Vietnam, which are responsible for almost half of global rice exports, recently set up the Organization of Rice Exporting Countries (OREC), although its mandate remains unclear.

Meanwhile, international commerce is quickly becoming a frontline for conflicts over natural resources at a time when the global economy is more dependent than ever on trading them. Export controls that many producer countries introduced in 2008 and 2011, for example, were intended to prevent sharp jumps in domestic food prices. In reality, the policies had the opposite effect, magnifying the spikes that hit food prices in those years.

A number of key suppliers of raw materials, including China and Indonesia, have introduced export controls as part of a broader shift toward a more interventionist industrial policy. Brazil and India are considering similar measures on iron ore. In the end, these confidence-eroding measures could be exacerbated by legal action in forums such as the World Trade Organization (WTO), resulting in a jamming of the WTO’s dispute settlement apparatus in the face of a possible commodity crisis.

All this factors into the new wave of resource nationalism that has emerged in recent years, driven in part by high volatility and fluctuating commodity prices. Resource-rich countries have been pushing aggressively for more control and a higher share of profits from their natural resources—especially projects in the extractive industries. In marked contrast to the wave of privatizations in the 1990s, governments have not shied away from declaring contracts void, expropriating assets or making investments through state-owned enterprises (SOE). [Also see “Resource Nationalism: Beyond Ideology,” p.120.]

Competition for critical resources, which is already acute in many parts of the world, may escalate, with the risk of a downward spiral of increasing competition—between sectors, communities and nations—and decreasing trust. This can be inflamed by resource nationalistic policies, such as the further proliferation of SOEs or sovereign wealth funds in overseas resource sectors—moves that have generated concern as being tools for foreign governments, although evidence so far is mixed.

The political economy of natural resources is increasingly being shaped by broader structural shifts that are already under way around the world: the changing natural environment; the deepening relationships between resource systems; and the rebalancing of global incomes and power structures.

The world must now contend not just with growing environmental threats such as climate change and water scarcities, but also with shifting consumer power from West to East, as well as the increased concentration of resource ownership and the rise of state capitalism. All of these moving pieces are changing the rules of the resources game.

Solutions to Cushion the Downside

To close the existing gaps on resource governance, I and my colleagues at Chatham House argue that the world’s principal resource-producing and -consuming countries should establish a “coalition of the committed.” This proposed club, the “Resources 30” (R30), would be composed of representatives from 30 countries of systemic significance as players in the resources markets, which—as major consumers, producers and exporters—are critical to the stability and functioning of the global system. Since they would be hardest hit by fluctuating prices—on one side of the market or the other—they also share a clear stake in dampening volatility. Specific members of the group would include a number of countries from the Western Hemisphere, including Brazil, Canada, Chile, Mexico, the United States, and Venezuela.

Other stakeholders could also be invited to engage in an expert or observer capacity. We envision the R30 as an informal but dedicated forum in which governments and stakeholders could address specific resource-related issues. Topics the group might cover include tackling price volatility, devising guidelines on the use of export restrictions and encouraging transparency of SOEs. The findings from meetings would feed into existing international institutions, such as the International Energy Agency (IEA), the WTO and the G20, to provide a specific, sectoral perspective on issues related to commodities. This could also obviate a potential impasse at the WTO by not creating a logjam in its dispute resolution mechanism.

The R30 could also tackle volatile resource prices, which existing international institutions are not capable of addressing. To date, there have been no credible international policy responses to volatile resource prices. Yet, given the dependence of the global economy on these unstable goods, there is a need for insurance mechanisms.

For example, in the case of food, no rules or agreements are in place to deal with export controls, to coordinate stockholdings or to reduce the impacts of biofuel mandates on food prices. Repeated attempts to discuss such approaches have been stalled by politics and the needs of individual governments to protect domestic interests.

Because of these past policy failures, it is now all the more critical that governments take intelligent, measured steps to combat resource price volatility. In the medium term, driving down resource intensity and encouraging sustainable use are the only remedies for high and volatile prices. Looking ahead, one key question that members can examine is developing and making better use of emergency reserves to reduce the impacts of short-term commodity price shocks.

In the case of oil, officials should accelerate efforts to expand or link the IEA’s emergency sharing mechanism to similar systems in emerging economies, especially China and India. Another proposal would enable companies that are critical to the global fuel supply to access a percentage of national reserves without prior government approval, but only in scenarios of force majeure, which would help mitigate localized disruptions before they affect international markets.

On food, major biofuel-producing countries could collectively purchase call options from their biofuel industries. This arrangement would act like a virtual global food reserve. Agreements could specify a trigger—based on a price index of food commodities—which, when activated, would obligate the producer to release feedstock back into food chains rather than for biofuels.

Another area in which there is a need for collaboration is improving global data and transparency on production, trade and reserves levels of particular metals. In this regard, traders could submit stockholding figures to an escrow service that would collate and make public key global data.

The work of the international commodity study groups for zinc, copper and other metals—which is currently accessible for a fee—could be published in a publicly accessible data hub and expanded to include production data for all key metals, in virgin and secondary markets.

More broadly, countries could work to agree on a set of guidelines that limit or even forbid the use of export restrictions in times of commodity price crisis. If adopted, this would remove one of the factors that exacerbated price spikes in the recent past.

Further, R30 could sponsor an annual assessment of the globe’s resources that could produce a standardized data bank. By systematizing the information and making it publicly available, NGOs could better scrutinize resource usage and extraction at the local level.

Building Resilience

At the same time, major economies should act quickly to help developing resource economies address the many challenges that they will face as they develop their resource sectors—which will be critical to ensuring long-term global resource security. The particular obstacles these countries may face include weak infrastructure, low-skilled workforces, water scarcity, and political instability, among other things. Taken together, such factors create an unfavorable investment climate that could threaten a country’s long-term production prospects.

Support to improve transparency, manage export and import dependencies, and strengthen environmental resilience in infrastructure investment and climate adaptation—especially in low-capacity producer states—is also critical. At the national level, developing countries should be urged to formulate clear policy incentives and government procurement rules in their resources sectors, which would create markets for environmentally sound products. They must include pricing structures that reflect the full environmental and social impacts of resource extraction and use.

Looking ahead, it is clear that the new geopolitics of resources will dominate global debate about how those resources should be properly managed. And these dynamics will play themselves out in a range of scenarios—trade wars, climate negotiations, market manipulation strategies, aggressive industrial policies. The key question is whether the world is ready to move collectively to a new global equilibrium under the current strains of the system. Tackling them now will require intense collaboration to set new policy guidelines and establish greater communication and transparency. But doing so will create a more stable environment for producers and consumers and—perhaps most important of all—allay fears of global resource scarcity.