When trade relations between Argentina and China hit choppy waters early last year, a new partner suddenly appeared on the horizon. In April 2010, Beijing stopped buying Argentine soybean oil in retaliation for Argentina’s restrictions on Chinese imports. That could have dealt a serious blow: Argentina is the world’s largest exporter of soybean oil, and China is the world’s largest importer. Efforts by the government of President Cristina Fernández de Kirchner failed to resolve the trade spat.

Enter India, which promptly tripled its own imports of Argentine soybean oil from $606 million in 2009 to $1.8 billion in 2010 (Chinese imports over that same period dropped from $1.8 billion to $240 million). This was followed by mutual visits between Argentine Minister of Agriculture Julián Domínguez and his Indian counterpart, Sharad Pawar, and the signing of a memorandum of understanding on agricultural cooperation. Total trade between Argentina and India reached $2.5 billion in 2010 and is likely to reach $3 billion in 2011.

Welcome to the new kid on the block in Latin America.

While much attention has been paid to China’s role in the Americas, the growing Indo-Latin American ties have been largely ignored by the press. But others have noticed the change. In 2010, the Inter-American Development Bank (IDB) issued a report entitled “India: Latin America’s next big thing?” followed by a similarly bullish report by the Sistema Económico Latinoamericano y del Caribe (SELA).

India’s Alternative: High Value Investment

India is now a palpable economic presence from the Caribbean to Uruguay, and its interests are remarkably diverse. Since 2000, Indian companies have invested about $12 billion in the region in information technology (IT), pharmaceuticals, agrochemicals, mining, energy, and manufacturing. Among the leading firms operating in the Americas today are the IT firm Tata Consultancy Services (TCS), Dr. Reddy’s Laboratories (pharma), United Phosphorus (agrochemicals), Shree Renuka Sugars, Havells Sylvania (lighting equipment), Videocon (television), and ONGC Videsh (oil).

In Bolivia, Jindal Steel & Power initiated a $2.3 billion investment in the iron ore mine El Mutún, the biggest foreign direct investment project in Bolivian history, and the biggest of any Indian company in Latin America.

In Trinidad and Tobago, Essar Steel is in the process of establishing a 2.5 million-ton steel plant. In 2002, TCS, the largest Indian IT company, established a Global Delivery Center in Montevideo that put Uruguay on the global IT map. TCS employs 900 Uruguayans and is one of the largest and most valued employers in the country.

Indian trade has not only made a difference in smaller countries like Bolivia, Trinidad and Tobago and Uruguay, but also in the larger South American nations—as the 2010 soybean deal with Argentina demonstrates. A year earlier, India bought $1 billion of sugar from Brazil to compensate for a shortfall in local production. Meanwhile, the Brazilian giant Embraer has sold planes in India, and Chile’s exports to India increased tenfold to $2.2 billion from 2003 to 2007. The two Indian IT companies operating in Chile—TCS and Evalueserve—employ more than 2,000 people.

In Argentina, there are 14 Indian companies, seven of which are in the IT and IT-enabled services sector, employing some 7,000 individuals, and the rest in various manufacturing areas, from pharma to cosmetics to agrochemicals. Venezuela has also dramatically increased its exports to India. In total, some 35,000 Latin Americans work for Indian companies in the region today—more than half in IT, business process outsourcing and knowledge process outsourcing.

From 2000 to 2009, Indo–LAC trade grew eightfold to approximately $20 billion. That’s still a long way behind the $140 billion in Chinese–Latin American trade, but that gap will likely continue to narrow in the years ahead. While there are real obstacles of geographic and cultural distance, modern technology’s ability to shrink time and space can help overcome them. Perhaps even more significantly, India does not have to copy China’s trade pattern in the Americas. Although it shares a number of features with its sister “Asian giant,” it offers a somewhat different menu of alternatives—as the diversity of commercial ventures noted above indicates.

But India’s increasing presence also adds to skepticism about whether the high profile of the Asian giants is healthy for Latin America. Many argue that the increased demand for Latin American imports, powered by the close to double-digit growth of a number of Asian economies, merely perpetuates the region’s classic role as a producer and exporter of mineral and agricultural products.

This reasoning is wrong. There is little doubt that the increased demand from Asia—most importantly, China and India—has given the region new momentum. Between 2003 and 2008, Latin America had its best economic performance in three decades, with an average annual growth rate of 5 percent, partly attributed to the boom in commodity prices.

The dramatic increase in the volume of trade between Asia and the region has not only raised the price of Latin American commodities, it has also allowed the nations of the Americas to diversify their exports from traditional markets in North America and Western Europe. In 2010, 40 percent of Chile’s exports went to Asia. In 2007, China had already displaced the United States as Chile’s primary export market, and India replaced Germany as its tenth-largest market. Something similar is happening in Argentina, Brazil and Peru.

At the same time, the foreign exchange bonanza has allowed Latin American countries to pay off their debt, increase their hard currency reserves and, in some cases, create their own sovereign wealth funds. It is thus difficult to argue that increased trade with the Asian giants is harmful to Latin America in the long run. Tellingly, Latin America’s ability to withstand the Great Recession of 2008–2009, a financial crisis originating in the North, was due not just to prudent macroeconomic management and financial regulation, but also to the circumstances of low debt and high foreign exchange reserves, made possible in part by trade with Asia.

Mother India in the New World

In the first half-century after Indian independence in 1947, the picture was very different. In addition to a considerable geographic distance—a major obstacle for trade and tourism at the time—India and the Latin American nations belonged to different clubs and rarely engaged each other. India was a member of the British Commonwealth and a founding member of the Non-Aligned Movement (NAM), neither of which had a significant Latin American presence. Indians thought of Latin American nations as unstable and plagued by coups, earthquakes and inflation. Latin Americans were shocked by India’s rampant poverty and internal conflicts.

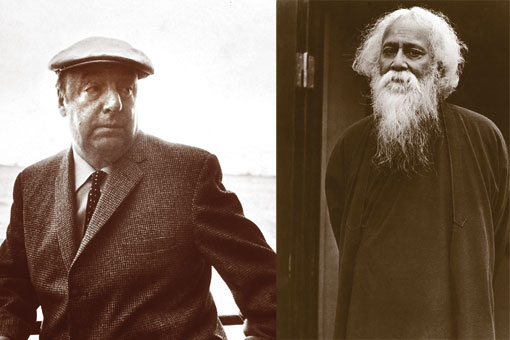

Only in literature did a dialogue of sorts exist. In the early twentieth century, Bengali poet Rabindranath Tagore’s verses influenced Chilean poet Pablo Neruda. Argentine cultural impresario Victoria Ocampo took the Indian writer under her wing, hosting him for two months in Buenos Aires in 1924–1925 and publishing his work in her magazine Sur. Mexican writer Octavio Paz, who was posted to New Delhi as a young diplomat in the 1950s and returned as an ambassador in the 1960s, was impressed by the depth and breadth of Indian civilization. In the 1990s, he even published a memoir of his time there, Vislumbres de la India.

Even in literary circles, though, obstacles abounded. Neruda visited India four times. In Madras, he was impressed by Indian women and their saris, wrapped “around the body with supernatural grace, covering them in a single flame as shining silk.” But he had a falling out with Prime Minister Jawaharlal Nehru, who in 1951 left him waiting for a long time before receiving him, and penned one of his darkest and most ominous poems, “India 1951.” The fact that India and many Latin American nations pursued import-substitution-industrialization (ISI) for much of the period following Indian independence did little to improve relations.

As recently as 1991–1992, Indo–LAC trade was less than $500 million. This changed with the opening of the Indian and Latin American economies in the 1990s. In 1997, six years after India instituted a series of reforms that liberalized its economy, it launched the FOCUS LAC program in partnership with the private sector to encourage business to expand to Latin America and the Caribbean. Indian exports increased elevenfold over the next 10 years. By 2004, Indo–LAC trade had reached $3 billion.

In Latin America, governments and the private sector saw opportunities in India’s large, growing market and were inspired by the emergence of India as an IT power. For their part, Indian industries discovered that Latin America provided a natural outlet for many of their products, including such traditional goods as textiles and garments as well as newer products like cars, pharmaceuticals, chemicals, and cosmetics. In some cases, they found that the middle-income countries of Latin America offered better markets than those of North America and Western Europe.

New Delhi, traditionally shunned by Latin diplomats as a “third-world backwater,” developed a new sheen as the capital of the global south. The number of LAC missions based in New Delhi increased from 12 in 2002 to 18 in 2009, and India’s missions in the region doubled from seven to fourteen. A preferential trade agreement between India and Chile went into effect in 2007, and another between India and Mercosur followed in 2009.

Warmer diplomatic relations also followed. In the first 50 years of Indian independence, only 12 presidential visits from Latin America to India took place. In the decade between 2001 and 2011 alone, there were 10.

Although no Chilean president had ever visited India, two did so in quick succession—Ricardo Lagos in 2005 and Michelle Bachelet in 2009. In 2001, Andrés Pastrana became the first Colombian president to visit the country, while Brazilian President Luiz Inácio Lula da Silva visited India three times during his tenure. In turn, Prime Minister Manmohan Singh visited Brazil twice (in 2006 and 2010), as well as Cuba and Trinidad and Tobago in 2009. President Pratibha Patil also visited Brazil, Chile and Mexico in 2008.

Building on the Two BRICs in the Wall

At the center of Indo-LAC relations is the Brazil-India link. Joined by the acronym that defined the decade (BRICs, the term coined by Goldman Sachs to refer to the emerging powers of Brazil, Russia, India, and China), and despite differing interests on some key issues like agriculture, Brazil and India have together taken on the role of leading the New South —that is, the post–Cold War developing world.

Initiatives like the IBSA (India, Brazil, South Africa) Dialogue Forum and the G20+ bloc of developing nations sprang from this growing relationship, culminating in the November 2008 creation of the G-20 at the leaders’ level—the “steering committee of the world economy,” in which Singh and Lula were key players.

President Lula’s nimble foreign policy and diplomatic initiatives helped counter the oft-held perception that “there are only two BRICs in the wall” (China and India, because of their large populations). Lula underscored Brazil’s complementarity with India, showing they have common global aspirations and a common agenda on many multilateral issues. This is particularly true on the economic front. Brazil has what India lacks: a large and fertile land mass with abundant water that can significantly increase the production of food—something India will always need, be it soybean oil, legumes or sugar.

The same goes for energy sources. After discovering enormous oil fields off its southern coast, Brazil is becoming an energy powerhouse, while India imports 70 percent of its oil needs. Bilateral trade of $6 billion in 2010 is projected to reach $10 billion by 2012. Indian companies have already invested some $1.5 billion in Brazil, and Brazilian companies $600 million in India.

A Brasilia–New Delhi axis will thus continue to ground the emerging international global architecture.

Some people argue that, because China represents 7.7 percent of Latin America’s foreign trade and India only 0.8 percent, there will always be a trade gap between India and Latin America due to long distance, high tariffs and labor restrictions. This notion is based on a misconception.

As noted economist Manmohan Agarwal has shown, if one allows for the 13-year difference between the opening of the Chinese economy in 1978 and that of the Indian economy in 1991, per-capita income, exports of goods and services as a share of GDP and foreign direct investment (FDI) inflows in India show similar trends to those seen in China a decade prior. In China, exports of goods and services as a share of GDP rose from 6 percent in 1979 to 20 percent in 1995; in India they increased from 7 percent in 1990 to 20 percent in 2005. Given that Indo-LAC trade in 2010 was approximately $20 billion—a much higher figure than the $12 billion in Sino-LAC trade in 2000—there is no reason not to think the growth potential is significant.

Moreover, the expansion of the Indian market is driven not just by high growth rates and sheer population size, but also by the rapid growth of India’s middle class—now approaching 300 million—who are increasingly adopting Western consumer habits. The potential growth in demand for commodities and other Latin American exports is sizeable. There will be no trade gap, just a trade lag.

Since 2000, Latin America’s solid economic performance has been accompanied by the diversification of export markets and of diplomatic ties. China’s increased presence in the Western Hemisphere has made a difference, but so has India’s. The potential of Indo-LAC trade and investment is considerable; India offers Latin America a diverse set of alternatives.

Most Indian trade and investment with Latin America is done by private Indian companies. Indian exports to the region are not a threat to Latin American industries. Over half of them consist of raw materials and intermediate goods such as bulk drugs, yarn, fabrics, and parts for machinery and equipment, which can help Latin American industries cut production costs and become globally competitive. Indian IT and business process outsourcing companies are propelling Latin America into the information age and training human resources for the knowledge economy. Bangalore has become a mandatory destination for Latin American delegations visiting the Indian subcontinent.

Realizing the potential of Indo-LAC partnerships requires overcoming mental, not geographic, hurdles. On the Latin side, many companies are unaware that, to take full advantage of the growing Indian market, they need to tailor production to specificities, as many Latin businesses already do with China.

On the Indian side, many companies, busy with their internal market, still do not focus sufficiently on Latin America. This contrasts with Chinese companies, which have the capacity and confidence to serve both their huge domestic market and foreign ones.

Due to domestic and regional foreign policy issues, Indian leaders have also found it difficult to pay the sort of attention to Latin America that China has. Over the past decade, Chinese presidents, prime ministers and foreign ministers have paid many visits to the region. In that same period, the Indian prime minister has visited only two countries in Latin America (Brazil and Cuba), the president three (Brazil, Chile and Mexico), and the foreign minister just a few. No high-level Indian official has ever visited Bolivia, though the latter is the location of India’s largest FDI project south of the Rio Grande.

Chinese concessional credit lines are ample and available to countries big and small, whereas Indian ones are smaller and confined to a few Caribbean and Central American nations. Additionally, high freight costs and a lack of direct shipping lines present continued obstacles, which can be surpassed, as the Chinese have shown.

India is emerging not just as a valuable trade partner to Latin American nations. The “New India” story of a stable, diverse democracy with high growth and deep cultural roots resonates in a Latin America trying to find its way in the twenty-first century.

At a time when Standard & Poor’s has declared that we may be “at the dawn of the Latin American decade,” and some have forecast that India’s growth rate will soon overtake China’s, present and potential synergies between India and the region should not be underestimated.

Views expressed in this article are personal and do not necessarily reflect those of the Government of India.