The framework for environmental stewardship, social responsibility and corporate governance, or ESG, remains a work in progress in Latin America. The region is starting to catch up, but adoption of ESG practices will require time and money as it entails a different way to assess operational and financial risks and opportunities. But there is a key component with the potential to bring high ESG returns at very low cost: increasing the share of women on the boards of directors of companies in the region.

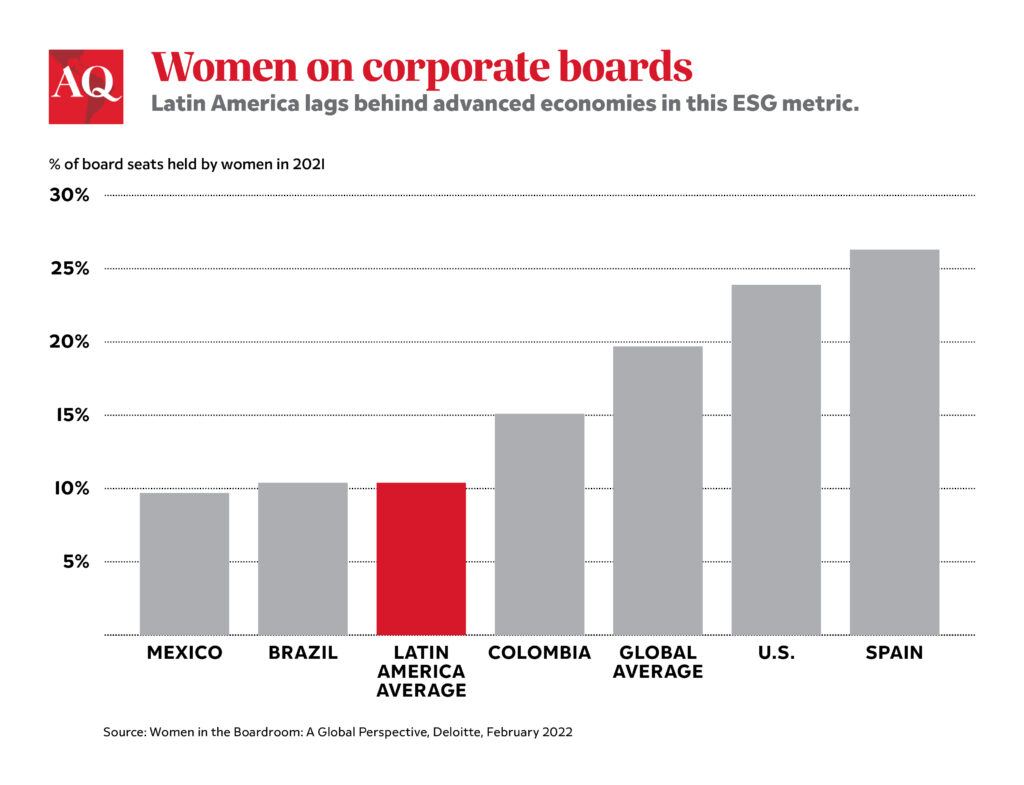

This is an ESG metric where Latin America does poorly at a global level. While women directors now occupy 20% of board seats of companies globally and 30% in advanced economies, in Latin America that number is closer to 11% of board seats, according to a report by Deloitte. This is also a big opportunity cost for companies in the region given the strength of the female talent pool in Latin America.

More diverse boards are one of the very few low-hanging fruits in ESG implementation. Some research has shown that more women represented on corporate boards lead to better ESG performance. Other research has shown a link between women’s leadership in a company and environmental performance. It also represents an opportunity for policymakers in Latin America in terms of the energy transition.

ESG in the spotlight

The current energy crisis has led to some backlash against the ESG framework. Criticism is healthy and necessary if ESG adoption and implementation in companies are to fulfill the potential to deliver more sustainable business practices that are also financially sound. But while ESG itself remains a work in progress, it did not spring out of thin air. However imperfect, the framework is grounded in the 2030 sustainable development goals and the Paris climate agreements formally upheld by U.N. member countries since 2015.

The region’s largest stock markets for example are members of the U.N.-led Sustainable Stock Exchange Initiative, which includes 120 stock markets around the world. Of the 15 stock markets in the region, which are partners in this initiative, about eight are already issuing ESG reports. At least seven exchanges—including Brazil, Chile, Colombia, Costa Rica, Mexico, Panama and Peru—already provide written guidance on ESG reporting for listed companies. Argentina, Brazil, Chile, Colombia, Mexico and Peru also provide investors with a sustainability index composed of companies that adopt ESG standards.

It is not only the region’s stock markets that are becoming the ambassadors of ESG adoption, it is also the region’s lenders that are in the driver’s seat. The financial sector, as shareholders of these companies or as their lenders, have also committed to following ESG standards and pushing for their adoption as part of their lending practices. This is a major driver of adoption. The flow of money into ESG-related stocks, bonds and other ESG assets has grown exponentially in the last years and stood at about $2.5 trillion in assets in the second quarter of 2022.

The region’s local banks are also committing themselves to follow ESG practices. For example, about 45 Latin American-owned banks are signatories of the U.N.-led Principles for Responsible Banking, an organization with almost 300 financial institutions worldwide representing almost half of the world’s total banking assets.

The case for more gender-diverse boards

ESG adoption is a process of institutional building inside companies and will take time. No matter where a company is in its ESG journey or the resources it has, increasing women’s board representation is a low-risk/high-impact step. For some, having more women on boards might be just about gender equality and doing the right thing. Also relevant from an ESG risk management perspective is to understand the added benefits in improving on this particular metric.

Research on the impact of more women on boards shows that it can potentially lead to improvements in corporate governance or the G in ESG. Corporate governance is about how companies make decisions, who makes them and how risks are managed. This includes how companies prevent misbehavior, limit corruption and promote ethical standards. In emerging markets dealing with weak institutions, any move that strengthens corporate governance can have significant positive effects. Companies that are perceived to be less trustworthy or exhibit weak corporate governance tend to face much higher borrowing costs and even a lack of access to the financial system. This is a problem that the region’s governments and its corporates are regrettably very familiar with (e.g. Lava Jato).

Research is also starting to show that there could be a link between companies with women in leadership positions in general, not only at the board level, and environmental performance. The region is starting to feel the impact of climate change in a more tangible way. Persistent and longer droughts are underscoring the costs of weather-related economic and physical risks. This means companies will need to think about future-proofing their balance sheets against both climate and energy transition risks, but also position themselves to capture their opportunities.

More diverse boards are also about avoiding group thinking and improving the overall decision-making environment. This is particularly important in periods of high volatility and uncertainty like the current one. Companies in Latin America are not unfamiliar with having to make strategic decisions amidst a very high degree of uncertainty about future scenarios. They are also not unfamiliar with operating in societies with a high degree of political polarization and political risks. But the added combination of climate risks, ESG requirements and geopolitical risks strengthens the case for more diverse points of view and backgrounds. And an obvious place to start is with more gender-diverse boards. This is one action item where the payoffs are high and the costs are low.