SAN SALVADOR – Walking around this capital days before the Feb. 5 elections, I was struck by how many people shared different versions of the same story: Nayib Bukele had changed their lives by dismantling El Salvador’s once-powerful gangs, and they had no doubt they would vote for him (many, for a second time). Still, one task was pending: Bukele has yet to transform the economy.

For now, pocketbook issues don’t seem to have taken much of a bite out of Bukele’s massive support. He won a second term (barred by the constitution but greenlit by the Supreme Court) with nearly 83% of the vote, while abstention hovered close to 50%, mimicking recent elections. The ruling party tilted the playing field in his favor using gerrymandering and public funds, and an unprecedented breakdown in the vote-counting and transmitting system raises questions about the integrity of the process. But the landslide win was primarily due to the big achievement of Bukele’s first term, vastly improving security, albeit at a steep cost to civil liberties and human rights.

With El Salvador’s gangs defeated, Bukele’s second administration will hinge on a different challenge: jumpstarting the economy. He is not short on ambitious plans, but neither is El Salvador on structural obstacles – including some of Bukele’s own making.

And the first challenge is around the corner. The government and the International Monetary Fund have been negotiating for months a financial assistance program, centered on key fiscal anchors and relevant structural reforms. While for observers one of the elephants in the room is El Salvador’s adoption of Bitcoin as legal tender, banks like J.P. Morgan expect that both sides will reach an agreement in the first semester of 2024, allowing the country to correct its fiscal imbalances and solve enduring liquidity issues.

Mixed Signals

In 2019, Bukele inherited an economy in bad shape. The government was already highly indebted, the country had for years received the least foreign direct investment of any of its Central American neighbors, and its top export industry, textiles, faced mounting competition from Asia. The gangs were an economic burden, costing Salvadorans an estimated 3% of GDP in extortion payments annually.

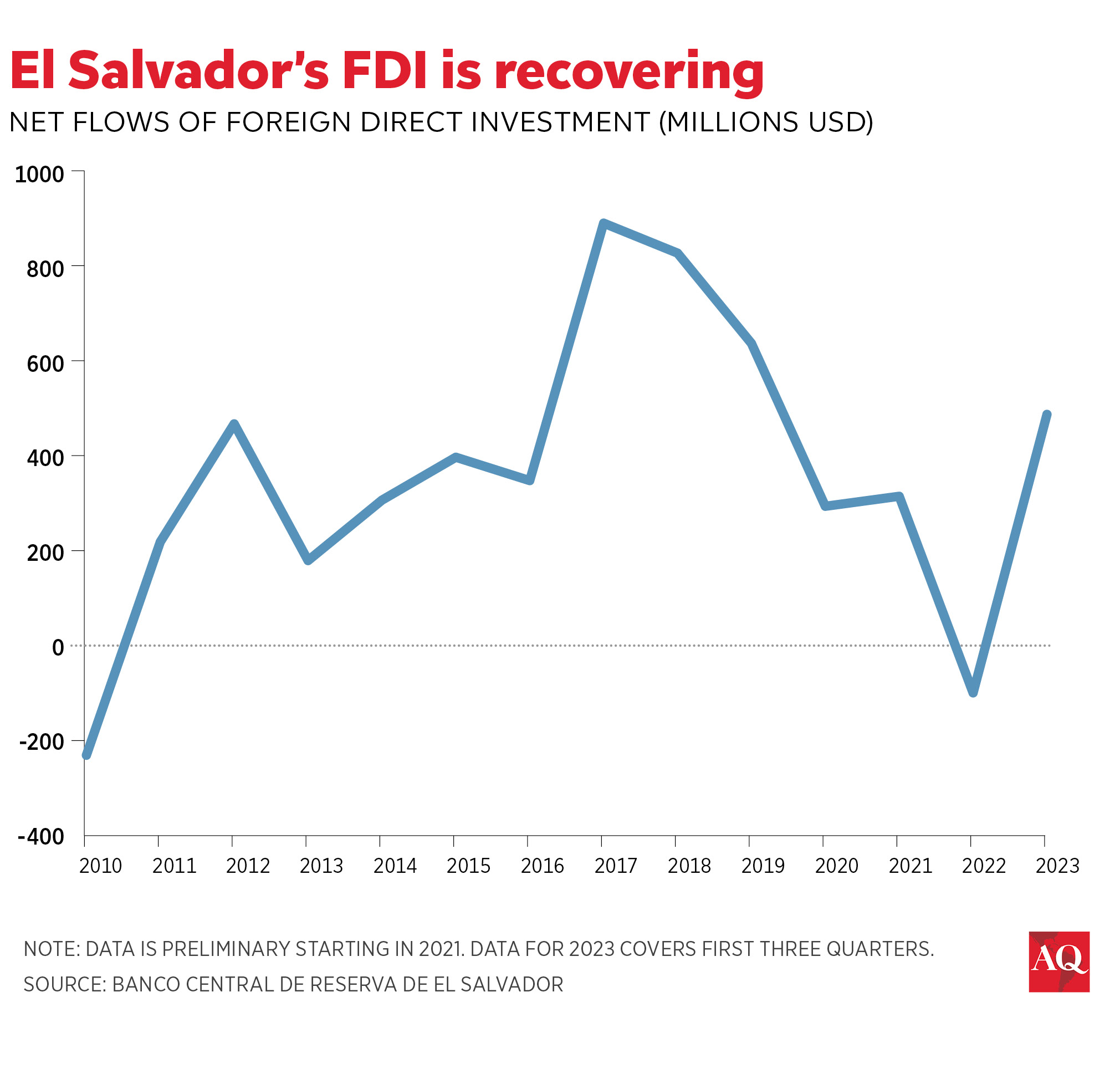

After Bukele’s first term, there are some signs of economic improvement: unemployment has fallen by about one percentage point, but consumer spending barely rose last year, amid an uptick in remittances. Foreign direct investment has improved somewhat, and after a negative $99 million performance in 2022, inflows during the first three quarters of 2023 reached $487 million. The yearly performance, however, still is poised to lag behind the $826 million El Salvador netted on FDI in 2018, the year before he got elected, and the country continues to rank last among its Central American neighbors on this metric.

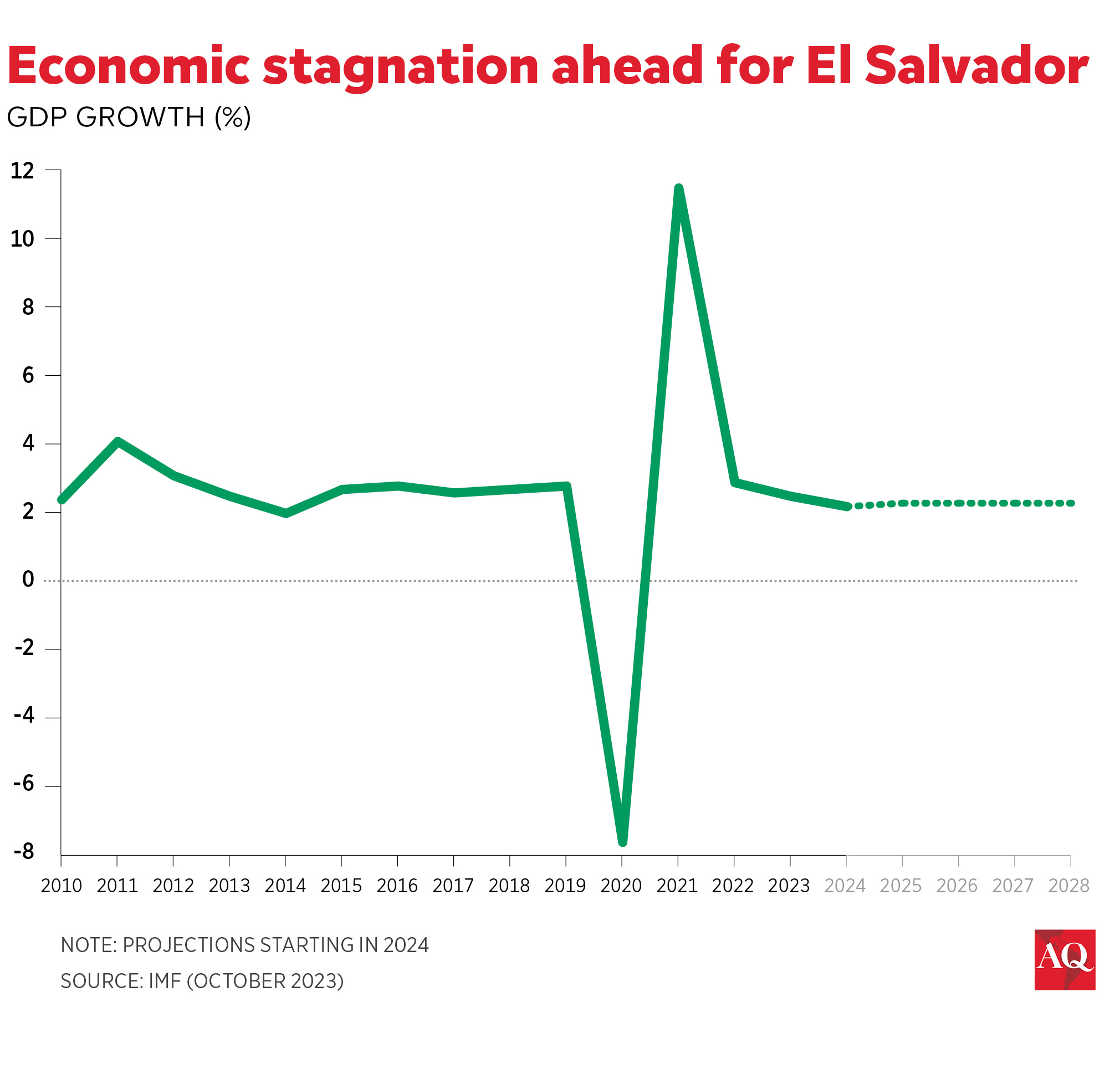

But other indicators point to stasis or worse. The IMF projects a 2024 GDP growth rate of just 1.9% – down from 2.5% when Bukele took office and a slowdown from last year— while the inflation rate is expected to track 2.4%. Still, the essential food basket per family in urban areas cost $257.06 in December 2023 – equivalent to three quarters of the Salvadoran monthly minimum wage, and up nearly 30% from the year Bukele took office.

When I visited a large market in an outlying neighborhood of San Salvador at noon on a weekday, I was surprised to see the hall virtually deserted besides the vendors, themselves. Almost half the country suffers moderate to severe food insecurity, up from earlier years, and the number of households living in extreme poverty nearly doubled between 2019 and 2022 (even as rates of moderate poverty have come down). As concern with crime has decreased, 70% of Salvadorans have come to see the economy as the country’s biggest problem.

Bukele’s growth model

In San Salvador, I interviewed Vice President Félix Ulloa to better understand the government’s plan for jumpstarting the economy. “We have the war against the gangs nearly won,” he told me, “now it’s on us to construct.” He listed several projects to stimulate growth: increased spending on education and tax incentives to build a tech sector, geothermal energy projects, EV manufacturing, and a plan to reactivate agriculture.

When I asked him if these sectors would generate enough jobs to meet the demand for employment among the largely urban population, he responded there would soon be plenty of work opportunities in tourism and services.

One urgent necessity is dealing with the country’s costly external debt. I asked Ulloa which the government would choose if forced to pick: an IMF loan or no loan and keeping Bitcoin as legal tender. “Maintain Bitcoin,” he responded confidently, arguing that the rising price of Bitcoin would enable the administration to amass reserves and pay back its creditors.

A bigger challenge could be agreeing on standard transparency and oversight procedures for public budgeting and contracting, which have eroded since Bukele took office. In the World Justice Project’s ranking of “open government,” a measurement of transparency based on an expert survey, El Salvador descended from spot 57 to 82 among countries ranked between 2019-2023 (it also declined in scores for constraints on government power, absence of corruption, and regulatory enforcement). Critics of the government told me doing away with the secrecy would be politically difficult for Bukele, exposing corruption inside his party. If, or more likely when, the IMF loan comes through, it will also require painful austerity cuts that could be hard to sell to the public.

Second, it will take quality, not just quantity, of education and infrastructure investment to make El Salvador a competitor for FDI. Companies will compare the country with Guatemala for agricultural investment, given its much larger and more developed industrial farming and its Atlantic ports. Competing with Costa Rica (where English is more widely spoken) for tech investment, or the Dominican Republic for tourist dollars will not be easy.

Then there may be the biggest stumbling block of all: the erosion of rule of law and separation of powers in El Salvador. Those trends have so far primarily threatened Bukele’s political opponents, several of whom have ended up in jail or exile. But lack of robust rights protections has a way of unnerving investors.

Several analysts close to the private sector I interviewed described how private sector figures who considered financing the opposition, or even spoke out against Bukele individually, faced persistent threats of tax audits and other coercive measures. A quarterly survey of investors shows that while they are much less worried about insecurity and political and economic instability since started Bukele leading the country, worry about judicial uncertainty – once barely a concern – has recently increased. El Salvador’s government, in its current form, presents risks not present in Costa Rica, the Dominican Republic or Panama: democracies with strong rule of law.

Bukele’s first term transformed El Salvador. According to nine in ten Salvadorans surveyed last June, the country is moving in the right direction. Whether the economy succeeds despite the obstacles, stagnates, or forces Bukele’s hand to adjust his governing style will shape his second term.