This article is adapted from AQ’s issue on China and Latin America

Picture the following scenario: Nicolás Maduro boards a Moscow-bound plane, a peaceful transition takes hold in Venezuela and state oil company PDVSA, under new management, starts a herculean reconstruction effort. The business-savvy directors and executives immediately put compliance on their priority list and hire an independent auditor to conduct a thorough internal investigation.

Then, the bombshell: The audit concludes that PDVSA laundered billions of dollars and was involved in kickbacks and illegal political donations in Venezuela and across Latin America – a multi-jurisdictional corruption enterprise that makes Odebrecht look like a downtown Caracas pickpocket.

Evidence of large-scale corruption involving PDVSA already abounds. The U.S. Treasury Department recently disclosed that in one currency exchange scheme alone from 2014 to 2015, senior managers laundered $1.2 billion (Odebrecht admitted to paying $788 million in bribes throughout 14 years). The Venezuelan opposition estimates that $30 billion has disappeared from PDVSA in recent years.

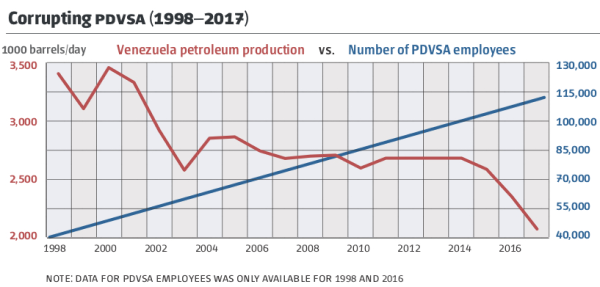

SOURCE: TRANSPARENCIA VENEZUELA; U.S. ENERGY INFORMATION ADMINISTRATION (EIA)

SOURCE: TRANSPARENCIA VENEZUELA; U.S. ENERGY INFORMATION ADMINISTRATION (EIA)

The question is not if the scenario above is likely to materialize, but what will be its consequences on a global scale when it arrives.

First, in an era when Washington claims quasi-universal jurisdiction over corruption-related matters, the fall of Caracas’ kleptocracy will trigger multiple judicial battles inside the U.S. There is already one major Foreign Corruption Practices Act (FCPA) case in a federal court involving Houston- and Florida-based PDVSA purchasing agents and contractors. But authorities will also go after PDVSA corruption in third countries since the U.S. financial system was probably used, including through Citgo.

The “new PDVSA” will likely borrow Petrobras’ defense following Lava Jato: namely, that the company was the biggest victim, not the perpetrator. Meanwhile, a delicate balancing act awaits U.S. authorities. Imposing heavy fines on Venezuela’s cash cow as the new government struggles to rebuild with U.S. assistance makes no sense. But simply cutting PDVSA loose would convey a message of impunity. Washington will tend to go for a middle ground alternative, like imposing an independent monitor on the company.

However, much more uncertain will be the political fallout in Latin American countries where PDVSA’s corruption took place. In this regard too, the Odebrecht scandal could pale in comparison.

As detailed evidence of PDVSA’s criminal enterprise emerges across the region, significant political volatility may follow. One window into that scenario is the current political crisis in Haiti, which was triggered by a major corruption scandal involving Petrocaribe, the oil diplomacy alliance with 14 Central American and Caribbean nations that Hugo Chávez began in 2005. A Haitian Senate probe found that private sector leaders and former government officials embezzled $2 billion in proceeds from Petrocaribe that were earmarked for disaster relief. Haitians launched the social media campaign #petrocaribechallenge to ask where the money went and took to the streets in a series of violent protests to demand the resignation of President Jovenel Moïse.

Petrocaribe-related corruption in Haiti also ensnared a prominent politician from the Dominican Republic. The Treasury Department sanctioned Senator Félix Bautista under the Global Magnitsky Act for allegedly laundering money from Petrocaribe—the politician’s companies were granted several contracts for reconstruction in Haiti.

In Petrocaribe countries ideologically aligned with chavismo, this corruption network may have been even more extensive. Daniel Ortega’s government in Nicaragua has used the opaque joint venture Albanisa (51% controlled by PDVSA, 49% by PetroNic) to distribute a reported $4 billion to Sandinista loyalists since 2007. In El Salvador, Alba Petróleos, is 60% owned by PDVSA and 40% owned by 18 mayors from the FMLN—along with Albanisa, the company was sanctioned by the Treasury Department in January 2019. FMLN loyalists allegedly used Alba Petróleos’ profits to finance the party’s election campaigns.

PDVSA’s corruption very likely went far beyond Petrocaribe. Argentina’s Investigative Financial Unit has put an alert on all PDVSA funds in the country since 2018 due to potential money laundering. A former manager at Conosur, PDVSA’s struggling Argentine subsidiary, testified that the company received payments from PDVSA starting at $3 million per month from 2009 to 2013, then $1 million per month from 2014 to 2018, to pay out bribes. In Brazil, police have investigated possible money laundering by PDVSA through imports of Brazilian agricultural equipment. The scheme allegedly involved the overcharging of $64 million between 2010 and 2014.

For now, the Venezuelan opposition – both at the National Assembly (AN) and through Interim President Juan Guaidó – has focused its limited resources on the seizure and recovery of assets from the Maduro regime, including money stolen from PDVSA and public coffers. Guaidó stated that he was alerted to irregular actions involving the Venezuelan government’s assets in Switzerland, and that he had spoken with Swiss authorities about freezing the accounts. In February, AN Finance Committee President Carlos Paparoni announced that the Maduro government is holding $3.2 billion in twenty U.S. bank accounts, and that the AN is working with the Trump administration to protect those assets. According to Paparoni, the AN has requested 152 banks in the Americas, Europe and Asia to freeze Venezuelan government accounts—the opposition plans to use those funds to finance Venezuela’s recovery. The U.S. is actively helping Guaidó’s team: in February, Washington notified Bulgaria about the transfer of millions of euros from PDVSA to a small bank in the Eastern European country, prompting the local government to freeze those accounts.

When a democratic transition finally gains momentum in Venezuela, the collapse of chavismo’s multinational corruption machine will pose an additional challenge to the new authorities in Caracas. The legal battles in U.S. courts related to money laundering, bribes and other forms of corruption will probably take years to be settled. And a new Venezuelan government will confront a political thunderstorm throughout the region caused by the disclosure of some of chavismo’s dirty secrets.

These legal and political time bombs will go off while an unprecedented reconstruction effort will already be consuming Venezuela’s new administration. At the same time, they could present a unique opportunity for the new government to put the fight against corruption at front and center of a reborn Venezuelan democracy.

—

Simon heads the Anti-Corruption Working Group and is Politics Editor at AQ. Sweigart is a researcher with the Anti-Corruption Working Group and a policy consultant at AQ.