A great way to understand Agustín Carstens is to hear how he defines himself and his peers —“The Generation of 12.50.”

That may sound obscure to outsiders, but anyone who grew up in Mexico during the 1950s, ’60s or ’70s instantly understands.

For 22 consecutive years, the peso was fixed at exactly 12.50 per dollar — and that number was as much a fixture of Mexican life as Cantinflas, Zonda-brand TVs or the Volkswagen Beetle. “Not everybody in our generation knew how to multiply by 12,” Carstens recalled with a soft chuckle, “but many people could by 12.50.” That is, until one ill-fated day in September 1976, when President Luis Echeverría, his term coming to an end following years of fiscal mismanagement, abruptly decided to end the peg and set the peso free.

What followed deserves a place among earthquakes, wars and foreign invasions in the all-time annals of Mexican catastrophes. Within a month, the peso had lost half its value, falling to 22.5 per dollar — and vaporizing the life savings of millions of people. Sugar, milk, meat and other staples disappeared from many shelves. In effect, the devaluation kicked off a horrible decade that would see Mexico default on its debt, nationalize banks, suffer from triple-digit inflation, and fail to create enough jobs for its bulging youth population, unleashing a northward exodus of unprecedented proportions whose effects can still be seen today. Through it all, the peso kept plummeting, to 148 per dollar by 1982 and a staggering 3,400 by 1993.

Yet crises are funny things — they often (though not always) give rise to a generation of leaders who make avoiding the same mistakes their life’s work. Indeed, less than a year after the devaluation, in August 1977, the Instituto Tecnológico Autónomo de México (ITAM), one of the country’s finest universities, admitted an unusually large — and extraordinary — group of economics students that would go on to radically change Mexico.

Among them was Carstens, who is today the president of Mexico’s central bank and, at age 57, one of the most respected economic officials in the emerging-market world. Mexico’s finance minister from 2006 to 2009, he has also served as a leading official at the International Monetary Fund (IMF) in Washington. In 2011, he was one of two finalists for the IMF’s top job, mounting a credible challenge to France’s Christine Lagarde. Reserved but easygoing, with a disarming chuckle and an encyclopedic knowledge of policy and history, Carstens enjoys broad support even from those critical of the current government. “He’s an ideal central banker,” said Isaac Katz, a professor and columnist.

Carstens and his peers have basically been running Mexico’s economy since the late 1980s. Even as ideologically different parties alternated in power, the core group of technocrats in the finance ministry and central bank has stayed largely the same. Under their watch, Mexico has, indeed, achieved a stability that the Generation of 12.50 could only have dreamed of. Inflation has run at a steady 4 percent for years. Public debt is manageable and interest rates are low. Mexico escaped the last big global financial crisis, in 2008–09, without bank failures or undue trauma.

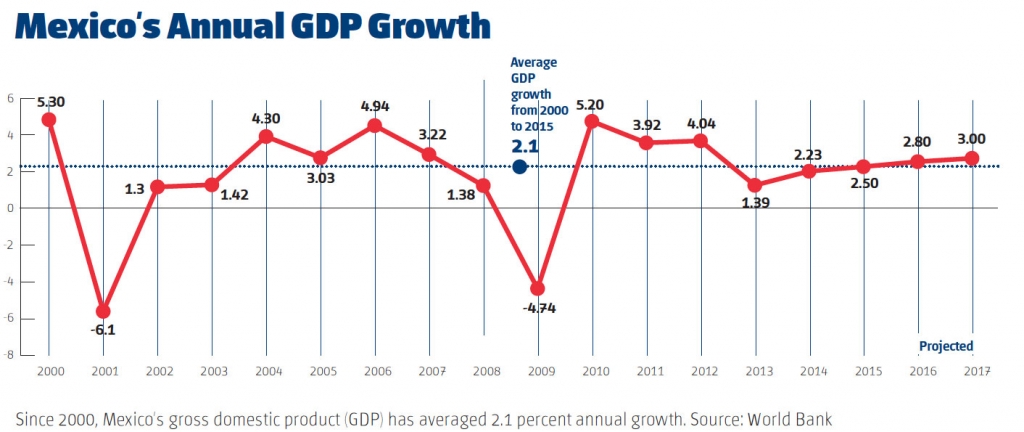

But there is a less flattering side. For all its stability, Mexico’s economy has averaged growth of only 2 percent so far this century. That’s not a tragedy, but it has also not been dynamic enough to reduce poverty — which has been stuck since 2010 at about 46 percent of the population, according to government figures. Growth has fallen well short of the 6 percent goal set by President Enrique Peña Nieto, who recently spoke of a nationwide “ill humor.” Meanwhile, on Wall Street and elsewhere, a mention of Mexico often elicits yawns — foreign direct investment this decade has averaged just 2 percent of gross domestic product, only half the level consistently seen in Colombia, Brazil and Peru.

Which raises the question: If Mexico’s economy has been run for so many years by brilliant technocrats such as Carstens, why on earth doesn’t it grow any faster?

Carstens nodded his head. “It’s a good question,” he said slowly, thoughtfully. “There are good answers, too.”

—

Those answers start, unsurprisingly, with a discussion of crises past. Carstens came from a family of accountants — middle-class, and presumably more prepared than most for such eventualities, they escaped the worst of the 1976 devaluation. Yet Carstens was still consumed by the same concerns as most Mexicans. On one trip home from the United States, his mother asked him to bring toothpaste because it was so scarce in Mexico, due to foreign exchange controls. “The need to stabilize the country was evident,” he recalled, and he decided to shun the family profession for something with “greater intellectual challenges.”

Carstens’ peers in that storied 1977 first-year class at ITAM made similar calculations. Luis de la Calle, who would later be instrumental in Mexico’s negotiation of the North American Free Trade Agreement (NAFTA), had intended to study law. But he and his father were so deeply shaken by the devaluation and its aftermath that, he said, “we made the collective decision” to study economics instead. “We were trained and encouraged not only to finish ITAM but also to do Ph.D.s in the best schools in the world,” De la Calle recalled, “with an eye toward participating in a revolution — the revolution of the economists.”

For Carstens, De la Calle and the other “revolutionaries,” their dogma was of course not Karl Marx but Adam Smith. Carstens did his Ph.D. at — where else? — the University of Chicago. He began his career at the central bank with a keen understanding of the fiscal problems that had triggered the crisis of his youth, but also the underlying political and social pressures.

“What became rather obvious — and it’s a challenge that started before that period, and one we still face — was that there were many social needs in Mexico,” Carstens said softly. “And perhaps the instincts of some politicians who were trying to satisfy those social needs, they were valid. But at the end of the day there are restrictions on the budget.”

Again, the easy chuckle. “Those budget restrictions, they can’t be ignored, and, well, if they’re ignored, there can be very perverse consequences, right?”

That, in a nutshell, is the philosophy of the Generation of 12.50. Carstens expresses it more humbly and humanely than most, which is probably why he has been so effective in politics. But the recipe is clear: a lean state, unadventurous monetary policy and greater integration with the global economy. If that all sounds obvious to, say, American ears… well, go ask Brazilians or Venezuelans how their economy has been run in recent years.

Some critics argue the “revolutionaries” have been too committed to the cause over the last 20 years. It’s one thing to have a lean state; but is Mexico’s too wispy to support basic needs? Has a zeal for small government kept Mexico from making the kinds of big investments in education or infrastructure that are necessary to reduce poverty over time? Mexico collects the equivalent of just 20 percent of its GDP in taxes, putting it last in the OECD club of mostly developed nations – behind the United States (24 percent) and the overall OECD average (34 percent). Those who oppose “neoliberal” policies often hold up Mexico’s mediocre growth as a shining example of their limitations.

In response, the model’s defenders say Mexico still hasn’t overcome its volatile reputation in financial centers like London and New York — and therefore doesn’t yet have the credit to engage in a big pro-growth investment drive. “Markets aren’t completely sold” on the idea of a more stable Mexico, De la Calle said. “Eventually we’ll get there.”

Carstens, for his part, cited the final gasp of Mexico’s troubled era, the 1994–95 “Tequila” crisis, which nearly collapsed the nation’s banks. Credit from the financial system to the public sector fell from more than 40 percent of GDP to below 10 percent — and while it has bounced back, it’s still below pre-Tequila levels. A more robust financial system could “easily” add a percentage point a year to GDP growth over time, Carstens said.

—

Indeed, Mexico does still feel like a country trying to atone for past sins — even for those seemingly too young to remember them. Fernando Aportela, the son of a highway patrolman in Veracruz, was just five years old when the devaluation occurred. But he felt compelled to study economics after watching it decimate his grandmother’s life savings. He got a job at the central bank and, thanks to mentors like Carstens, received guidance on how to get into the best graduate schools. After getting his Ph.D. at the Massachusetts Institute of Technology (MIT), Aportela returned home and is today the undersecretary for finance and public credit.

For Aportela and others, the path to faster growth lies partly in reforms passed by President Peña Nieto at the start of his term. Fiscal changes have already helped wean Mexico from its dependence on oil, which accounted for 39 percent of total revenues in 2012 but only 20 percent last year. As a result, Mexico has largely escaped aftershocks from the recent crash in crude prices.

“Young people didn’t have to live through the inflation of the past,” Aportela said. “But things are improving.” Another reform, in the telecommunications sector, is also promising. The changes allowed for greater competition, and broadband prices have fallen about a third in real terms. Today, the telecoms sector is growing at a whopping 20 percent annual pace. Undersecretary for Communications Mónica Aspe Bernal was born in 1977 at MIT, where her father, Pedro, who would later become finance minister and in many ways the godfather of the Generation of 12.50, was doing graduate work.

She sees the reforms as another step toward that generation’s goals. “We’ve learned the importance of competition, and how important it is for a government to take tough measures,” she said.

Still, the work of technocrats can only do so much. Alejandro Poiré, who was secretary of the interior under Mexico’s previous government, pointed to widespread corruption and monopolies as continued barriers to growth. He was at a Starbucks in Mexico City, where a group of 20-something entrepreneurs was meeting at the next table.

“Those are the guys that should be driving the economy. But the moment they come into competition with a bigger company, the one that knows a compadre in the government…” Poire’s voice trailed off, and he shook his head. “When that happens, it doesn’t matter if your cell phone bill is only 20 dollars a month.”

De la Calle agreed, pointing out that states close to the U.S. border with relatively solid institutions and exposure to the global economy have been growing faster than 4 percent this decade. Other, less-connected states with high levels of corruption and organized crime barely grow at all. Those in Mexico’s judicial sector now need to lead a ‘revolution’ of their own, he said, citing Brazil’s“Car Wash” probe as an example.

Some work has been done. Carstens, as finance minister, oversaw an initiative that significantly restricted cross-border bank transfers for money of questionable origin. An upcoming telecoms auction will have the Mexican chapter of Transparency International auditing the bidding. Carstens pointed to falling tax evasion and an improvement in the “quality of fiscal spending” at the federal level, although he said there are still “challenges” in states and municipalities.

Whether Mexicans are willing to continue waiting for a bigger payoff — or whether they might opt for a substantial change in the next presidential election, in 2018 — is an open question. But Carstens urges patience — and, all these years later, is still pursuing his generation’s ultimate goal.

“This problem of guiding a country so that it progresses, so that it can develop in a complete and integral way, all of society, without leaving people behind, well, it’s a big challenge,” he said. “It’s a challenge that we haven’t resolved, and it will be difficult. We’re working on it.”

—

Winter is the editor-in-chief of Americas Quarterly. He spent a decade living in Latin America as a correspondent for Reuters, and was based in Mexico City from 2004 to 2005.