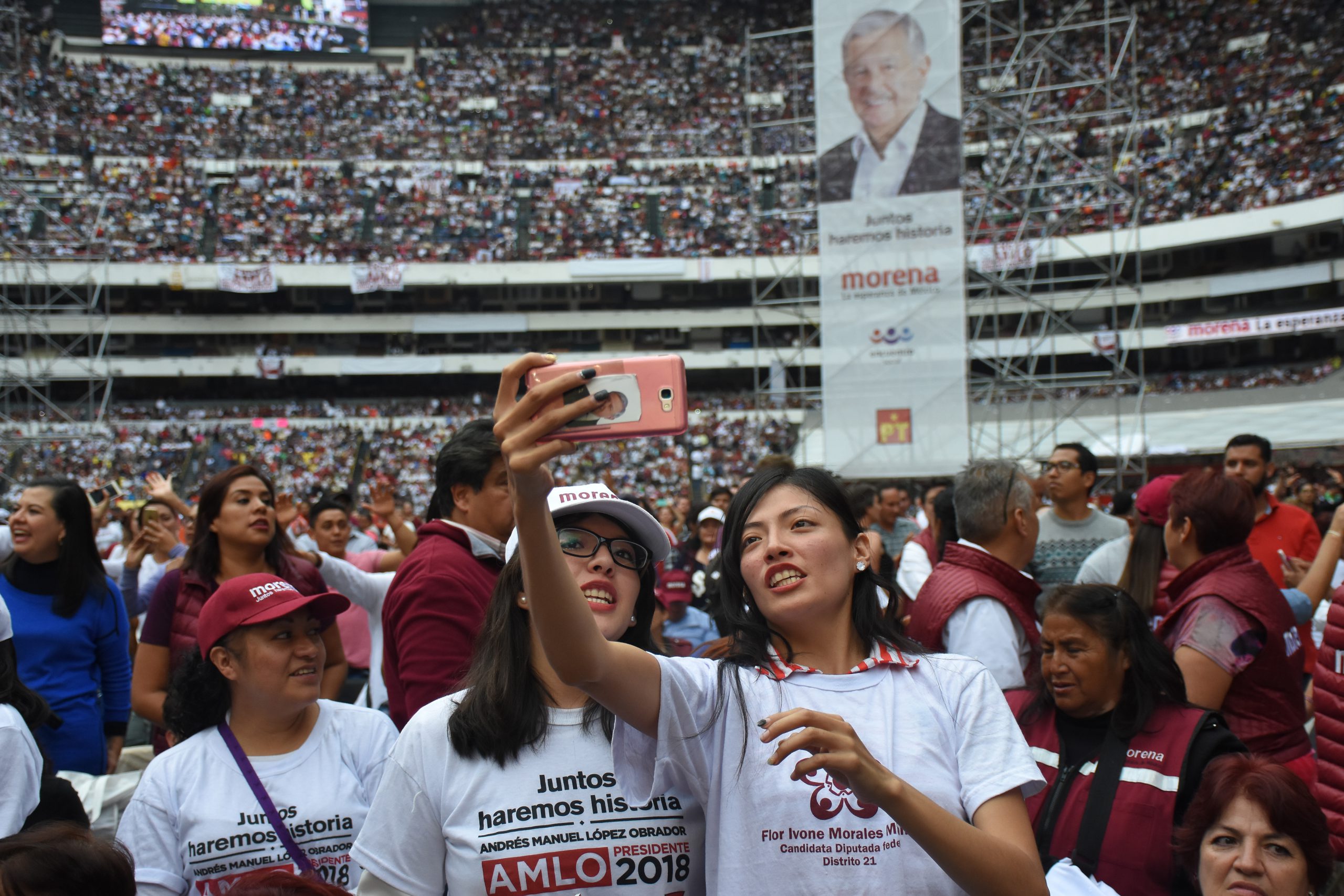

More than a year has passed since Andrés Manuel López Obrador was elected Mexico’s president and Pemex, the state energy firm that he has vowed to revive, is in as much trouble as ever. In July the company reported a $2.7 billion loss for the second quarter of 2019. The results are unsettling, but also consistent with the gaping losses that have become customary for Pemex – the company was in the red by triple that amount in the same quarter last year. Much more worrying is that there appears to be no credible plan to right the ship.

Pemex unveiled a new five-year strategy in July, but the proposals that it prescribes may do more harm than good. Investors have assailed it as being long on wishful thinking and short on realistic steps to hit its targets.

In the upstream, the strategy calls for Pemex to achieve around 2.7 million barrels per day (bpd) of production by 2024, roughly one million more than its current output. The company aims to do this by prioritizing the development of 20 fields over the next two years – 16 in shallow water and four onshore – that it can quickly bring into production. The plan all but abandons exploration of deep-water fields that are more expensive to operate but which hold most of Mexico’s oil wealth.

In the downstream, the new strategy doubles down on López Obrador’s commitment for Pemex to build a new 340,000 bpd refinery in his home state of Tabasco. Pemex is underwriting the project largely because world-class engineering firms were themselves unable to present proposals that came in under the government’s desired costs. The administration has been resolute that the project will cost no more than $8 billion and will be finished by 2022.

The big question mark is how to finance its plan. Pemex is already the most indebted oil company in the world, with total debt of around $111 billion at the end of 2018. Its payment obligations to the government are also untenable. According to Fitch Ratings, upwards of 80% of the company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) get transferred to the government, which at times has put the company in the awkward spot of having to borrow from creditors to meet its government obligations. Fitch downgraded the company’s long-term credit to junk status in June, and all three major ratings agencies have a negative outlook for Pemex, suggesting the likelihood of another downgrade in the medium term.

The government’s plan proposes a two-fold solution. First, it will reduce the tax liability on oil that it collects from Pemex. The current rate of 65% will be trimmed to 58% in 2020 and 54% in 2021. It also plans to inject roughly $7.4 billion of new capital into the company over the next three years. Both measures point in the right direction but fall well short of what’s needed to stabilize the company, according to analysts. Citi Research calculates that Pemex would need between $10 billion and $15 billion annually of capital injections to meet its investment targets. The bank also believes that the shortfall in funding has raised the likelihood that Moody’s will follow Fitch in downgrading Pemex to junk. Concerns have amplified that Pemex’s troubles could drag down Mexico’s sovereign rating, which Fitch has at just the second-lowest investment grade status.

Rather than relying so heavily on Pemex, the consensus from industry is that the better, more systemic chance to boost Mexico’s declining oil production – and consequently resource revenues – is through significant investments from private sector partners. For now, those avenues are cut off. López Obrador halted new bid rounds for upstream oil blocks shortly after taking office. More recently, he suspended Pemex’s process of farming out stakes in projects to private investors. The government says it will allow private participation through service agreements, essentially reverting to the model that was in place prior to Mexico’s 2013 energy reforms.

Ironically, some international companies that are developing projects from blocks they acquired in auctions before López Obrador took office are making steady progress. Italy’s Eni produced its first oil from a field in July, one year ahead of schedule. U.S. independent Talos Energy and BP’s affiliate Pan American Energy are also on good footing to produce in coming years. Positive results from international operators are necessary conditions that López Obrador has set for possibly resuming oil auctions.

But in the meantime, the gap that has been established in private industry’s inability to access Mexico’s resources means that Pemex will be going it alone for the foreseeable future. The company still accounts for virtually all of Mexico’s oil production. And with insufficient capital being invested into its production capacities, the outlook for the sector is becoming increasingly bleak. Indeed, Carlos Urzúa, who abruptly resigned as finance minister in early July, cited major discrepancies in economic policy in his decision to quit. Urzúa was widely viewed as a moderate, business-friendly voice within the administration. Since resigning he has singled out the Tabasco refinery as an ill-conceived investment whose funds would be better served for exploration and production. The president is betting that a strong state energy company will deliver sustained growth for the country. But by overloading and underequipping it, he is hampering its ability to achieve just that.

—

Mendoza is director of the energy program at AS/COA