MEXICO CITY— In a year in which about half of the adult population in the world will vote and several national elections are set to be dramatic, Mexico is a puzzle. On June 2, the country will vote for president, 128 federal senators and 500 congresspeople, governors in nine states (including Mexico City), and local congresses and municipalities—all in all, a whopping 20,000 public offices will be up for grabs. Moreover, as happens every 12 years, electoral cycles in Mexico and the U.S. will coincide, and the former is bound to become an “electoral piñata” in the latter’s own acrimonious race.

Yet, markets would suggest Mexico is an oasis of tranquility, a “boring long,” so to speak. After rallying by 15% against the U.S. dollar in 2023, the Mexican peso has posted an additional 2.1% gain this year, the only major currency still outperforming the mighty greenback. Credit default swaps (CDS), which measure the cost of insuring against a government defaulting on its debts, tell a similar story: at 92 points, they are significantly lower than Brazil’s (144) and Colombia’s (149) and have been hovering below the 100 mark for the last 12 months.

What’s the explanation for this performance? If my interpretation of several conversations with global investors is correct, they assume that Claudia Sheinbaum, the presidential candidate of the incumbent Morena party and the anointed successor of Andrés Manuel López Obrador (AMLO) is a shoo-in. Since they have been mostly lukewarm about AMLO, they are also relatively indifferent about Sheinbaum; they see continuity and perhaps some mild turn for the better on issues such as energy policy.

Prudent fiscal management often attributed to AMLO (more on this below) will also be the norm, it is assumed, and moreover, there are all those bright prospects for nearshoring. In a world where geopolitical blocs are the new normal, Mexico is in the right neighborhood. In 2022, the countries with which it shares land borders had a combined gross domestic product of $25.5 trillion.

This compares with $6.8 trillion for countries bordering China —including $3.4 trillion from potential geopolitical rival India. No other BRICS country comes closer to such a privileged postal code—Brazil’s neighborhood reaches a paltry $1.5 trillion.

In this prevalent view, elections are thus a mere formality and proximity to the U.S. a blessing, irrespective of who sits in the Oval Office. Alas, I believe things could turn out to be much more complicated. For instance, the presidential race appears to be heating up, as it often happens at this stage of the competition. Eighteen years ago, I quoted T.S. Eliot on “April being the cruelest month,” and indeed, it was in April 2006 when polls first showed Felipe Calderón ahead of AMLO. Perhaps 2024 will bring “La maldita primavera”, The Damned Spring, a term coined by Alejandro Moreno, a political scientist and pollster.

Beyond the polls

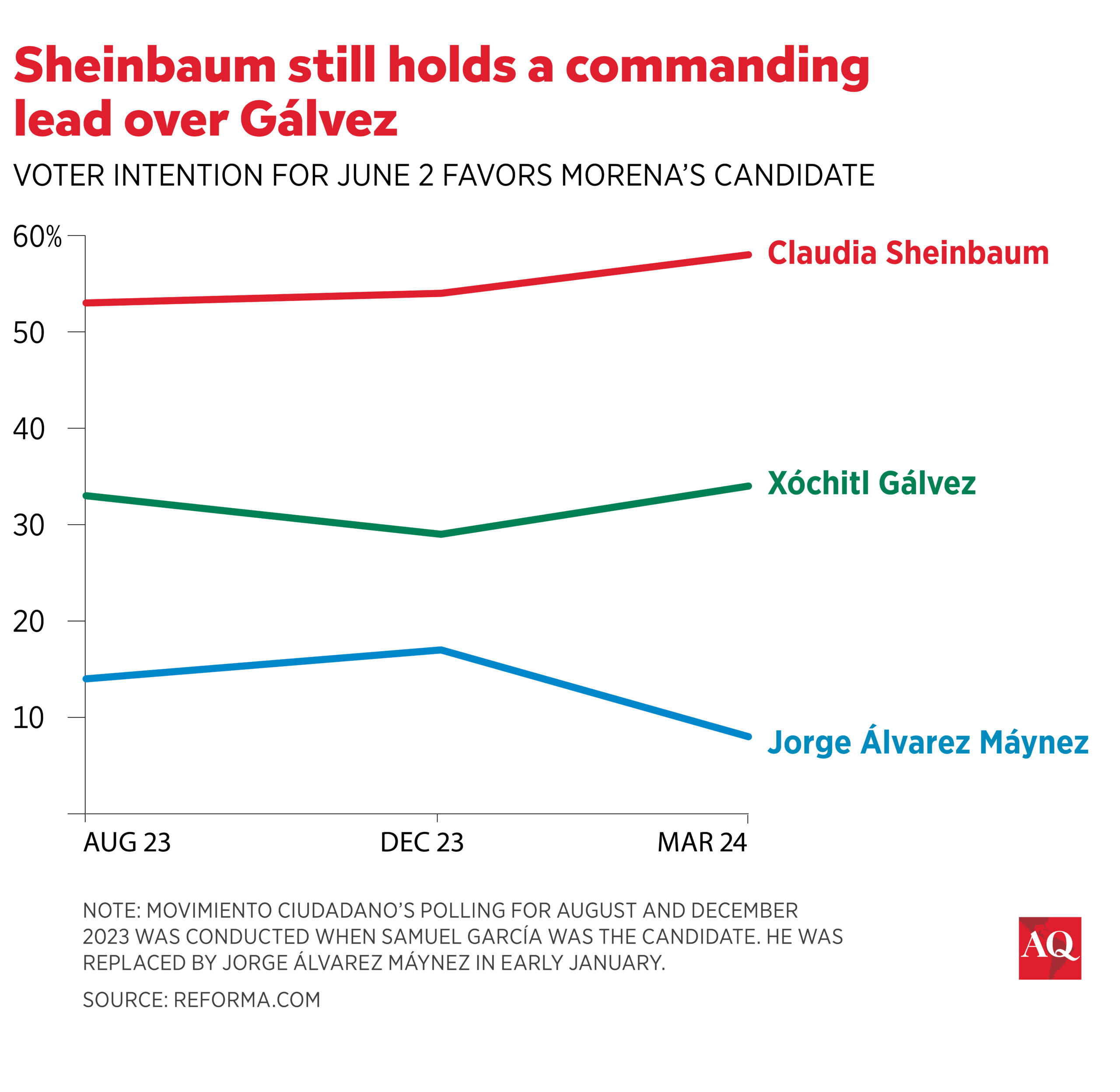

At first sight, circumstances are different: Polls show Sheinbaum well ahead of opposition candidate Xóchitl Gálvez (59% vs. 35% in net vote intention according to the poll aggregator Oraculus). However, there is an ongoing debate on whether polls are unbiased gauges of voter intentions or an instrument of electoral propaganda, aimed at portraying the contest as a fait accompli. The final verdict will, of course, come on June 2, but my impression on the ground is that Sheinbaum is no longer benefiting from the sense of inevitability polls would suggest. At the local level, for instance, five out of the six states with the largest number of eligible voters (30% of the national total) will elect a governor. Morena currently rules in three of them—Mexico City, Veracruz and Puebla—but it is struggling in the first two.

The first of three presidential debates has already taken place. It was a rather dull exercise. Nevertheless, the impression that Sheinbaum is on the defensive and Gálvez on the offensive was reinforced; it certainly did not look like a settled affair. The next few days will probably bring a new batch of surveys where I would look beyond the polling on the candidates and into the number of undecided voters and/or the proportion of those who intend to vote, as I believe the more Mexicans decide to vote, the more intense the competition will be.

So, what would happen in the case of a Xóchitl Gálvez victory?

As I said, this is not yet on global investors’ radar, but I believe they would welcome this outcome; their positioning would not be significantly altered.

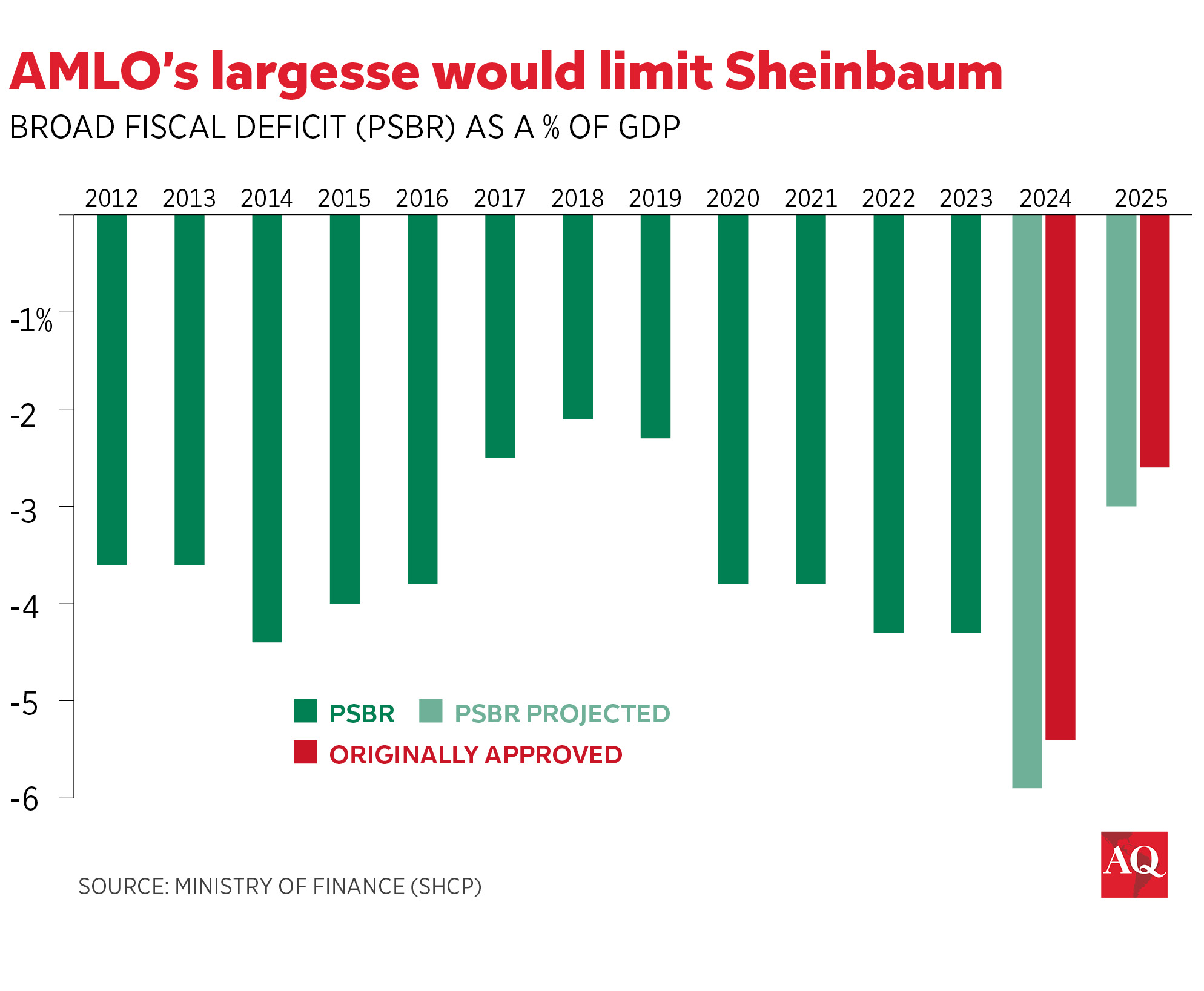

There are pending challenges irrespective of the winner, but Gálvez would not face the additional restrictions apparently imposed by AMLO on his successor. The government, for instance, announced days ago that the broad deficit (PSBR) for 2024 will reach 5.9% of GDP instead of the already heady 5.4% originally approved. But then it adds that in 2025, the new administration will reduce outlays to cut this ratio in half to 3.0% of GDP, and presto! Problem solved. In other words, AMLO is leaving to the next president the kind of expenditure cuts that Javier Milei is struggling to implement in Argentina, but probably with caveats regarding his flagship programs and the state-owned Petróleos Mexicanos, Pemex.

Gálvez, meanwhile, would be in a better position to balance expenditure cuts with revenue measures and even a more gradualist approach to fiscal balances, particularly as her team is likely to be better qualified to deal with these challenges. This is, I believe, quite important: Choices of Cabinet members and government officials based on competence rather than exclusively based on loyalty would be a welcome change from the AMLO years. Behind closed doors, U.S. officials agree with this view, which I believe constitutes an underestimated risk in Mexico’s most important bilateral relationship.

A possible scenario

The problem, however, would be the transition period. When posed with the question of whether AMLO would accept an opposition victory, virtually every person I have talked to in Mexico has answered in the negative, and several recent statements by the president reinforce this worrying conviction. Since I do not believe markets are currently pricing in the possibility of a post-electoral conflict, its materialization would lead to an episode of substantial volatility.

The aftermath of the 2006 election was characterized by an “AMLO-tantrum” as he and his followers occupied Mexico City’s main thoroughfare for months claiming electoral fraud—AMLO even declared himself the “legitimate president.” Taking into account that this time around AMLO is the sitting president, the question of what he would willing to do this time sends shivers down the spine of every person with whom I have discussed this possibility. One shrewd analyst suggested the possibility of el voto del miedo (“the vote of fear”, meaning people voting for the status quo in order to avoid, in AMLO’s terms, “letting the tiger loose”) becoming a factor to consider in this election. Markets are unlikely to remain aloft in such circumstances.

Mexico, therefore, might end up as yet another example of the recurrent markets versus politics dilemma: Would you prefer steady valuations under the status quo, even if that means dimmer long-term prospects? Or short spells of volatility, where institutions are tested to the extreme, hoping they end up strengthened? Since Mexican voters might answer this question differently from investors, it pays to consider how things might turn out on June 2 and beyond.